aecom infrastructure & environment uk limited Company Information

Company Number

00880328

Next Accounts

Jun 2026

Shareholders

aecom design & consulting services uk limited

Group Structure

View All

Industry

Environmental consulting activities

Registered Address

aldgate tower 2 leman street, london, E1 8FA

Website

http://www.urs.comaecom infrastructure & environment uk limited Estimated Valuation

Pomanda estimates the enterprise value of AECOM INFRASTRUCTURE & ENVIRONMENT UK LIMITED at £299.2m based on a Turnover of £251.1m and 1.19x industry multiple (adjusted for size and gross margin).

aecom infrastructure & environment uk limited Estimated Valuation

Pomanda estimates the enterprise value of AECOM INFRASTRUCTURE & ENVIRONMENT UK LIMITED at £135.6m based on an EBITDA of £12.5m and a 10.85x industry multiple (adjusted for size and gross margin).

aecom infrastructure & environment uk limited Estimated Valuation

Pomanda estimates the enterprise value of AECOM INFRASTRUCTURE & ENVIRONMENT UK LIMITED at £394m based on Net Assets of £185.5m and 2.12x industry multiple (adjusted for liquidity).

Edit your figures and get a professional valuation report.

Aecom Infrastructure & Environment Uk Limited Overview

Aecom Infrastructure & Environment Uk Limited is a live company located in london, E1 8FA with a Companies House number of 00880328. It operates in the environmental consulting activities sector, SIC Code 74901. Founded in May 1966, it's largest shareholder is aecom design & consulting services uk limited with a 100% stake. Aecom Infrastructure & Environment Uk Limited is a mature, mega sized company, Pomanda has estimated its turnover at £251.1m with low growth in recent years.

Aecom Infrastructure & Environment Uk Limited Health Check

Pomanda's financial health check has awarded Aecom Infrastructure & Environment Uk Limited a 3.5 rating. We use a traffic light system to show it exceeds the industry average on 4 measures and has 5 areas for improvement. Company Health Check FAQs

4 Strong

2 Regular

5 Weak

Size

annual sales of £251.1m, make it larger than the average company (£797.4k)

£251.1m - Aecom Infrastructure & Environment Uk Limited

£797.4k - Industry AVG

Growth

3 year (CAGR) sales growth of 3%, show it is growing at a slower rate (18%)

3% - Aecom Infrastructure & Environment Uk Limited

18% - Industry AVG

Production

with a gross margin of 40.2%, this company has a comparable cost of product (41.4%)

40.2% - Aecom Infrastructure & Environment Uk Limited

41.4% - Industry AVG

Profitability

an operating margin of 4.6% make it less profitable than the average company (5.8%)

4.6% - Aecom Infrastructure & Environment Uk Limited

5.8% - Industry AVG

Employees

with 2706 employees, this is above the industry average (10)

2706 - Aecom Infrastructure & Environment Uk Limited

10 - Industry AVG

Pay Structure

on an average salary of £59.5k, the company has a higher pay structure (£42.1k)

£59.5k - Aecom Infrastructure & Environment Uk Limited

£42.1k - Industry AVG

Efficiency

resulting in sales per employee of £92.8k, this is equally as efficient (£88.2k)

£92.8k - Aecom Infrastructure & Environment Uk Limited

£88.2k - Industry AVG

Debtor Days

it gets paid by customers after 15 days, this is earlier than average (48 days)

15 days - Aecom Infrastructure & Environment Uk Limited

48 days - Industry AVG

Creditor Days

its suppliers are paid after 8 days, this is quicker than average (22 days)

8 days - Aecom Infrastructure & Environment Uk Limited

22 days - Industry AVG

Stock Days

There is insufficient data available for this Key Performance Indicator!

- - Aecom Infrastructure & Environment Uk Limited

- - Industry AVG

Cash Balance

has cash to cover current liabilities for 2 weeks, this is less cash available to meet short term requirements (38 weeks)

2 weeks - Aecom Infrastructure & Environment Uk Limited

38 weeks - Industry AVG

Debt Level

it has a ratio of liabilities to total assets of 45%, this is a lower level of debt than the average (55.1%)

45% - Aecom Infrastructure & Environment Uk Limited

55.1% - Industry AVG

AECOM INFRASTRUCTURE & ENVIRONMENT UK LIMITED financials

Aecom Infrastructure & Environment Uk Limited's latest turnover from September 2024 is £251.1 million and the company has net assets of £185.5 million. According to their latest financial statements, Aecom Infrastructure & Environment Uk Limited has 2,706 employees and maintains cash reserves of £2.3 million as reported in the balance sheet.

Data source: Companies House, Pomanda Estimates

| Sep 2024 | Sep 2023 | Sep 2022 | Oct 2021 | Oct 2020 | Sep 2019 | Sep 2018 | Sep 2017 | Sep 2016 | Oct 2015 | Oct 2014 | Dec 2013 | Dec 2012 | Dec 2011 | Dec 2010 | May 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Turnover | 251,113,000 | 264,049,000 | 247,778,000 | 231,399,000 | 240,178,000 | 253,100,000 | 265,646,000 | 268,778,000 | 293,999,000 | 269,272,000 | 224,319,000 | 269,602,000 | 275,370,000 | 216,073,000 | 150,146,000 | 257,437,000 |

| Other Income Or Grants | ||||||||||||||||

| Cost Of Sales | 150,182,000 | 163,433,000 | 156,424,000 | 142,053,000 | 148,586,000 | 159,331,000 | 167,972,000 | 168,366,000 | 191,154,000 | 168,762,000 | 122,153,000 | 145,993,000 | 155,503,000 | 117,454,000 | 96,469,000 | 143,218,000 |

| Gross Profit | 100,931,000 | 100,616,000 | 91,354,000 | 89,346,000 | 91,592,000 | 93,769,000 | 97,674,000 | 100,412,000 | 102,845,000 | 100,510,000 | 102,166,000 | 123,609,000 | 119,867,000 | 98,619,000 | 53,677,000 | 114,219,000 |

| Admin Expenses | 89,339,000 | 85,310,000 | 79,662,000 | 80,803,000 | 88,684,000 | 87,343,000 | 84,948,000 | 86,153,000 | 93,761,000 | 132,231,000 | 91,459,000 | 108,326,000 | 113,544,000 | 122,274,000 | 65,613,000 | 100,718,000 |

| Operating Profit | 11,592,000 | 15,306,000 | 11,692,000 | 8,543,000 | 2,908,000 | 6,426,000 | 12,726,000 | 14,259,000 | 9,084,000 | -31,721,000 | 10,707,000 | 15,283,000 | 6,323,000 | -23,655,000 | -11,936,000 | 13,501,000 |

| Interest Payable | 5,362,000 | 7,919,000 | 3,739,000 | 898,000 | 790,000 | 780,000 | 1,193,000 | 974,000 | 13,568,000 | 14,270,000 | 47,000 | 14,529,000 | 14,739,000 | 15,299,000 | 10,963,000 | 14,613,000 |

| Interest Receivable | 10,978,000 | 10,517,000 | 4,514,000 | 1,677,000 | 1,785,000 | 1,573,000 | 729,000 | 376,000 | 9,534,000 | 9,912,000 | 405,000 | 15,473,000 | 14,488,000 | 13,812,000 | 9,147,000 | 10,766,000 |

| Pre-Tax Profit | 17,208,000 | 17,031,000 | 12,467,000 | 6,430,000 | 1,008,000 | 3,756,000 | 7,844,000 | 9,359,000 | 7,571,000 | -40,332,000 | 11,971,000 | 16,664,000 | 6,099,000 | -8,723,000 | -12,782,000 | 11,280,000 |

| Tax | -1,992,000 | -722,000 | 2,351,000 | 2,764,000 | 642,000 | -1,814,000 | -1,829,000 | -2,513,000 | -6,029,000 | 7,559,000 | -4,105,000 | -8,375,000 | -5,239,000 | 6,031,000 | 3,681,000 | -3,530,000 |

| Profit After Tax | 15,216,000 | 16,309,000 | 14,818,000 | 9,194,000 | 1,650,000 | 1,942,000 | 6,015,000 | 6,846,000 | 1,542,000 | -32,773,000 | 7,866,000 | 8,289,000 | 860,000 | -2,692,000 | -9,101,000 | 7,750,000 |

| Dividends Paid | ||||||||||||||||

| Retained Profit | 15,216,000 | 16,309,000 | 14,818,000 | 9,194,000 | 1,650,000 | 1,942,000 | 6,015,000 | 6,846,000 | 1,542,000 | -32,773,000 | 7,866,000 | 8,289,000 | 860,000 | -2,692,000 | -9,101,000 | 7,750,000 |

| Employee Costs | 160,908,000 | 159,380,000 | 149,237,000 | 144,916,000 | 152,401,000 | 149,164,000 | 146,891,000 | 147,724,000 | 149,140,000 | 143,531,000 | 110,908,000 | 130,881,000 | 126,654,000 | 111,899,000 | 87,497,000 | 133,156,000 |

| Number Of Employees | 2,706 | 2,688 | 2,769 | 2,810 | 3,094 | 3,101 | 3,111 | 3,277 | 3,242 | 3,140 | 3,118 | 3,037 | 2,960 | 2,992 | 3,100 | 3,261 |

| EBITDA* | 12,493,000 | 16,470,000 | 12,903,000 | 9,649,000 | 6,583,000 | 8,733,000 | 14,987,000 | 16,995,000 | 12,386,000 | -28,919,000 | 15,420,000 | 21,405,000 | 13,123,000 | -16,888,000 | -6,635,000 | 21,972,000 |

* Earnings Before Interest, Tax, Depreciation and Amortisation

| Sep 2024 | Sep 2023 | Sep 2022 | Oct 2021 | Oct 2020 | Sep 2019 | Sep 2018 | Sep 2017 | Sep 2016 | Oct 2015 | Oct 2014 | Dec 2013 | Dec 2012 | Dec 2011 | Dec 2010 | May 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tangible Assets | 4,602,000 | 4,859,000 | 7,467,000 | 7,231,000 | 6,431,000 | 5,583,000 | 7,279,000 | 8,874,000 | 9,874,000 | 11,010,000 | 16,648,000 | 14,841,000 | 15,300,000 | 17,901,000 | 14,646,000 | 17,475,000 |

| Intangible Assets | 36,373,000 | 36,798,000 | 35,626,000 | 35,633,000 | 35,617,000 | 35,623,000 | 35,641,000 | 35,717,000 | 36,213,000 | 36,793,000 | 33,705,000 | 35,617,000 | 38,032,000 | 40,443,000 | 35,118,000 | 36,533,000 |

| Investments & Other | 47,826,000 | 53,705,000 | 62,481,000 | 96,134,000 | 23,603,000 | 2,485,000 | 2,513,000 | 2,517,000 | 2,514,000 | 2,531,000 | 2,569,000 | 729,000 | 2,474,000 | 6,585,000 | 6,654,000 | |

| Debtors (Due After 1 year) | ||||||||||||||||

| Total Fixed Assets | 88,801,000 | 95,362,000 | 105,574,000 | 138,998,000 | 65,651,000 | 43,691,000 | 45,433,000 | 47,108,000 | 48,601,000 | 47,803,000 | 52,884,000 | 53,027,000 | 54,061,000 | 60,818,000 | 56,349,000 | 60,662,000 |

| Stock & work in progress | ||||||||||||||||

| Trade Debtors | 10,987,000 | 15,694,000 | 17,089,000 | 11,718,000 | 37,976,000 | 51,507,000 | 49,465,000 | 52,720,000 | 61,328,000 | 61,405,000 | 73,991,000 | 30,632,000 | 76,128,000 | 86,355,000 | 64,374,000 | 79,575,000 |

| Group Debtors | 204,834,000 | 160,133,000 | 181,301,000 | 149,008,000 | 182,662,000 | 494,425,000 | 302,523,000 | 287,670,000 | 238,300,000 | 48,187,000 | 50,829,000 | 49,952,000 | 55,542,000 | 50,826,000 | 22,683,000 | 21,157,000 |

| Misc Debtors | 30,538,000 | 36,056,000 | 42,621,000 | 70,338,000 | 55,191,000 | 45,205,000 | 39,804,000 | 48,371,000 | 58,627,000 | 50,956,000 | 15,170,000 | 49,206,000 | 18,307,000 | 20,376,000 | 16,466,000 | 9,414,000 |

| Cash | 2,269,000 | 2,228,000 | 3,923,000 | 4,821,000 | 19,325,000 | 6,350,000 | 8,230,000 | 10,431,000 | 15,186,000 | 5,517,000 | 8,268,000 | 9,757,000 | 10,501,000 | 9,064,000 | 3,289,000 | 8,410,000 |

| misc current assets | ||||||||||||||||

| total current assets | 248,628,000 | 214,111,000 | 244,934,000 | 235,885,000 | 295,154,000 | 597,487,000 | 400,022,000 | 399,192,000 | 373,441,000 | 166,065,000 | 148,258,000 | 139,547,000 | 160,478,000 | 166,621,000 | 106,812,000 | 118,556,000 |

| total assets | 337,429,000 | 309,473,000 | 350,508,000 | 374,883,000 | 360,805,000 | 641,178,000 | 445,455,000 | 446,300,000 | 422,042,000 | 213,868,000 | 201,142,000 | 192,574,000 | 214,539,000 | 227,439,000 | 163,161,000 | 179,218,000 |

| Bank overdraft | 1,102,000 | 5,000 | 6,218,000 | 1,705,000 | ||||||||||||

| Bank loan | 7,000,000 | 9,000,000 | ||||||||||||||

| Trade Creditors | 3,579,000 | 3,778,000 | 6,551,000 | 1,110,000 | 1,088,000 | 421,000 | 17,939,000 | 12,492,000 | 10,492,000 | 11,449,000 | 10,089,000 | 5,200,000 | 10,030,000 | |||

| Group/Directors Accounts | 35,314,000 | 8,812,000 | 36,002,000 | 39,714,000 | 47,674,000 | 338,068,000 | 187,299,000 | 176,220,000 | 127,336,000 | 4,806,000 | 17,634,000 | 12,832,000 | 32,362,000 | 37,702,000 | 15,251,000 | 38,861,000 |

| other short term finances | 30,000 | |||||||||||||||

| hp & lease commitments | 675,000 | 580,000 | 618,000 | 724,000 | 1,338,000 | 190,000 | 409,000 | 410,000 | 365,000 | 14,000 | 185,000 | 390,000 | 1,337,000 | |||

| other current liabilities | 11,099,000 | 10,994,000 | 10,681,000 | 20,413,000 | 39,218,000 | 35,696,000 | 44,090,000 | 44,425,000 | 58,976,000 | 50,110,000 | 41,007,000 | 42,842,000 | 47,434,000 | 47,362,000 | 44,757,000 | 49,123,000 |

| total current liabilities | 50,667,000 | 24,164,000 | 53,852,000 | 60,851,000 | 88,230,000 | 373,954,000 | 232,908,000 | 222,143,000 | 187,098,000 | 72,855,000 | 72,235,000 | 66,166,000 | 91,264,000 | 101,556,000 | 74,303,000 | 108,381,000 |

| loans | 31,637,000 | |||||||||||||||

| hp & lease commitments | 386,000 | 1,119,000 | 1,699,000 | 1,678,000 | 2,766,000 | 197,000 | 409,000 | 494,000 | 3,000 | 341,000 | 474,000 | |||||

| Accruals and Deferred Income | ||||||||||||||||

| other liabilities | ||||||||||||||||

| provisions | 32,168,000 | 33,946,000 | 43,237,000 | 47,247,000 | 3,839,000 | 5,669,000 | 5,013,000 | 10,782,000 | 18,313,000 | 22,806,000 | 4,610,000 | 6,586,000 | 8,040,000 | 10,157,000 | 11,327,000 | 3,027,000 |

| total long term liabilities | 101,258,000 | 117,851,000 | 148,424,000 | 214,756,000 | 209,347,000 | 180,653,000 | 144,299,000 | 195,643,000 | 230,446,000 | 155,447,000 | 105,439,000 | 84,912,000 | 63,074,000 | 65,467,000 | 42,961,000 | 80,695,000 |

| total liabilities | 151,925,000 | 142,015,000 | 202,276,000 | 275,607,000 | 297,577,000 | 554,607,000 | 377,207,000 | 417,786,000 | 417,544,000 | 228,302,000 | 177,674,000 | 151,078,000 | 154,338,000 | 167,023,000 | 117,264,000 | 189,076,000 |

| net assets | 185,504,000 | 167,458,000 | 148,232,000 | 99,276,000 | 63,228,000 | 86,571,000 | 68,248,000 | 28,514,000 | 4,498,000 | -14,434,000 | 23,468,000 | 41,496,000 | 60,201,000 | 60,416,000 | 45,897,000 | -9,858,000 |

| total shareholders funds | 185,504,000 | 167,458,000 | 148,232,000 | 99,276,000 | 63,228,000 | 86,571,000 | 68,248,000 | 28,514,000 | 4,498,000 | -14,434,000 | 23,468,000 | 41,496,000 | 60,201,000 | 60,416,000 | 45,897,000 | -9,858,000 |

| Sep 2024 | Sep 2023 | Sep 2022 | Oct 2021 | Oct 2020 | Sep 2019 | Sep 2018 | Sep 2017 | Sep 2016 | Oct 2015 | Oct 2014 | Dec 2013 | Dec 2012 | Dec 2011 | Dec 2010 | May 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Operating Activities | ||||||||||||||||

| Operating Profit | 11,592,000 | 15,306,000 | 11,692,000 | 8,543,000 | 2,908,000 | 6,426,000 | 12,726,000 | 14,259,000 | 9,084,000 | -31,721,000 | 10,707,000 | 15,283,000 | 6,323,000 | -23,655,000 | -11,936,000 | 13,501,000 |

| Depreciation | 476,000 | 563,000 | 1,204,000 | 1,101,000 | 3,669,000 | 2,289,000 | 2,185,000 | 2,185,000 | 2,722,000 | 2,047,000 | 2,801,000 | 3,707,000 | 4,389,000 | 4,420,000 | 3,886,000 | 6,386,000 |

| Amortisation | 425,000 | 601,000 | 7,000 | 5,000 | 6,000 | 18,000 | 76,000 | 551,000 | 580,000 | 755,000 | 1,912,000 | 2,415,000 | 2,411,000 | 2,347,000 | 1,415,000 | 2,085,000 |

| Tax | -1,992,000 | -722,000 | 2,351,000 | 2,764,000 | 642,000 | -1,814,000 | -1,829,000 | -2,513,000 | -6,029,000 | 7,559,000 | -4,105,000 | -8,375,000 | -5,239,000 | 6,031,000 | 3,681,000 | -3,530,000 |

| Stock | ||||||||||||||||

| Debtors | 34,476,000 | -29,128,000 | 9,947,000 | -44,765,000 | -315,308,000 | 199,345,000 | 3,031,000 | 30,506,000 | 197,707,000 | 20,558,000 | 10,200,000 | -20,187,000 | -7,580,000 | 54,034,000 | 103,523,000 | 110,146,000 |

| Creditors | -199,000 | -2,773,000 | 6,551,000 | -1,110,000 | 22,000 | 667,000 | -17,518,000 | 5,447,000 | 2,000,000 | -957,000 | 1,360,000 | 4,889,000 | 5,200,000 | 10,030,000 | ||

| Accruals and Deferred Income | 105,000 | 313,000 | -9,732,000 | -18,805,000 | 3,522,000 | -8,394,000 | -335,000 | -14,551,000 | 8,866,000 | 9,103,000 | -1,835,000 | -4,592,000 | 72,000 | 2,605,000 | 44,757,000 | 49,123,000 |

| Deferred Taxes & Provisions | -1,778,000 | -9,291,000 | -4,010,000 | 43,408,000 | -1,830,000 | 656,000 | -5,769,000 | -7,531,000 | -4,493,000 | 18,196,000 | -1,976,000 | -1,454,000 | -2,117,000 | -1,170,000 | 11,327,000 | 3,027,000 |

| Cash flow from operations | -25,847,000 | 33,125,000 | -1,884,000 | 81,781,000 | 324,225,000 | -201,274,000 | 4,045,000 | -37,439,000 | -204,495,000 | -9,172,000 | -696,000 | 26,214,000 | 14,779,000 | -58,567,000 | -45,193,000 | -29,524,000 |

| Investing Activities | ||||||||||||||||

| capital expenditure | -500,000 | -1,196,000 | ||||||||||||||

| Change in Investments | -5,879,000 | -8,776,000 | -33,653,000 | 72,531,000 | 21,118,000 | -28,000 | -4,000 | 3,000 | 2,514,000 | -2,531,000 | -38,000 | 1,840,000 | -1,745,000 | -4,111,000 | 6,585,000 | 6,654,000 |

| cash flow from investments | 5,879,000 | 8,776,000 | 33,653,000 | -72,531,000 | -21,118,000 | 28,000 | -496,000 | -1,199,000 | ||||||||

| Financing Activities | ||||||||||||||||

| Bank loans | -7,000,000 | 7,000,000 | 9,000,000 | |||||||||||||

| Group/Directors Accounts | 26,502,000 | -27,190,000 | -3,712,000 | -7,960,000 | -290,394,000 | 150,769,000 | 11,079,000 | 48,884,000 | 122,530,000 | -12,828,000 | 4,802,000 | -19,530,000 | -5,340,000 | 22,451,000 | 15,251,000 | 38,861,000 |

| Other Short Term Loans | 30,000 | |||||||||||||||

| Long term loans | 31,637,000 | |||||||||||||||

| Hire Purchase and Lease Commitments | -638,000 | -618,000 | -85,000 | -1,702,000 | 3,914,000 | -416,000 | -213,000 | -40,000 | 859,000 | -14,000 | -174,000 | -543,000 | 731,000 | 1,811,000 | ||

| other long term liabilities | ||||||||||||||||

| share issue | ||||||||||||||||

| interest | 5,616,000 | 2,598,000 | 775,000 | 779,000 | 995,000 | 793,000 | -464,000 | -598,000 | -4,034,000 | -4,358,000 | 358,000 | 944,000 | -251,000 | -1,487,000 | -1,816,000 | -3,847,000 |

| cash flow from financing | 34,310,000 | -22,293,000 | 31,116,000 | 17,971,000 | -310,478,000 | 167,527,000 | 44,121,000 | 65,416,000 | 136,745,000 | -22,315,000 | -20,734,000 | -45,594,000 | -6,840,000 | 30,632,000 | 76,164,000 | 59,884,000 |

| cash and cash equivalents | ||||||||||||||||

| cash | 41,000 | -1,695,000 | -898,000 | -14,504,000 | 12,975,000 | -1,880,000 | -2,201,000 | -4,755,000 | 9,669,000 | -2,751,000 | -1,489,000 | -744,000 | 1,437,000 | 5,775,000 | 3,289,000 | 8,410,000 |

| overdraft | -1,102,000 | 1,102,000 | -5,000 | -6,213,000 | 4,513,000 | 1,705,000 | ||||||||||

| change in cash | 41,000 | -1,695,000 | -898,000 | -14,504,000 | 12,975,000 | -1,880,000 | -2,201,000 | -4,755,000 | 9,669,000 | -1,649,000 | -2,591,000 | -739,000 | 7,650,000 | 1,262,000 | 1,584,000 | 8,410,000 |

aecom infrastructure & environment uk limited Credit Report and Business Information

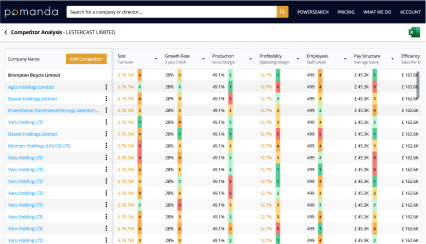

Aecom Infrastructure & Environment Uk Limited Competitor Analysis

Perform a competitor analysis for aecom infrastructure & environment uk limited by selecting its closest rivals, whether from the PROFESSIONAL, SCIENTIFIC AND TECHNICAL ACTIVITIES sector, other mega companies, companies in E 1 area or any other competitors across 12 key performance metrics.

aecom infrastructure & environment uk limited Ownership

AECOM INFRASTRUCTURE & ENVIRONMENT UK LIMITED group structure

Aecom Infrastructure & Environment Uk Limited has 1 subsidiary company.

Ultimate parent company

AECOM

#0010686

2 parents

AECOM INFRASTRUCTURE & ENVIRONMENT UK LIMITED

00880328

1 subsidiary

aecom infrastructure & environment uk limited directors

Aecom Infrastructure & Environment Uk Limited currently has 4 directors. The longest serving directors include Mr Simon Hindshaw (Jul 2013) and Mr Andrew Barker (Sep 2019).

| officer | country | age | start | end | role |

|---|---|---|---|---|---|

| Mr Simon Hindshaw | England | 65 years | Jul 2013 | - | Director |

| Mr Andrew Barker | United Kingdom | 57 years | Sep 2019 | - | Director |

| Mr Richard Whitehead | United Kingdom | 57 years | Sep 2019 | - | Director |

| Mr Richard Whitehead | United Kingdom | 57 years | Mar 2025 | - | Director |

P&L

September 2024turnover

251.1m

-5%

operating profit

11.6m

-24%

gross margin

40.2%

+5.48%

turnover

Turnover, or revenue, is the amount of sales generated by a company within the financial year.

Balance Sheet

September 2024net assets

185.5m

+0.11%

total assets

337.4m

+0.09%

cash

2.3m

+0.02%

net assets

Total assets minus all liabilities

aecom infrastructure & environment uk limited company details

company number

00880328

Type

Private limited with Share Capital

industry

74901 - Environmental consulting activities

incorporation date

May 1966

age

59

incorporated

UK

ultimate parent company

accounts

Full Accounts

last accounts submitted

September 2024

previous names

urs infrastructure & environment uk limited (March 2015)

urs scott wilson ltd (December 2011)

See moreaccountant

-

auditor

ERNST & YOUNG LLP

address

aldgate tower 2 leman street, london, E1 8FA

Bank

THE ROYAL BANK OF SCOTLAND PLC

Legal Advisor

-

aecom infrastructure & environment uk limited Charges & Mortgages

A charge, or mortgage, refers to the rights a company gives to a lender in return for a loan, often in the form of security given over business assets.

We found 5 charges/mortgages relating to aecom infrastructure & environment uk limited. Currently there are 0 open charges and 5 have been satisfied in the past.

aecom infrastructure & environment uk limited Capital Raised & Share Issues BETA

When a company issues new shares, e.g. to new investors following a funding round, it is required to notify Companies House within one month of making an allotment of shares.

Click to start generating capital raising & share issue transactions for AECOM INFRASTRUCTURE & ENVIRONMENT UK LIMITED. This can take several minutes, an email will notify you when this has completed.

aecom infrastructure & environment uk limited Companies House Filings - See Documents

| date | description | view/download |

|---|