tri-it limited Company Information

Group Structure

View All

Industry

Other information technology and computer service activities

Registered Address

fairgate house 205 kings road, tyseley, birmingham, west midlands, B11 2AA

Website

http://tri-it.co.uktri-it limited Estimated Valuation

Pomanda estimates the enterprise value of TRI-IT LIMITED at £166.4k based on a Turnover of £233.5k and 0.71x industry multiple (adjusted for size and gross margin).

tri-it limited Estimated Valuation

Pomanda estimates the enterprise value of TRI-IT LIMITED at £0 based on an EBITDA of £-2.4k and a 4.85x industry multiple (adjusted for size and gross margin).

tri-it limited Estimated Valuation

Pomanda estimates the enterprise value of TRI-IT LIMITED at £34.8k based on Net Assets of £15.5k and 2.25x industry multiple (adjusted for liquidity).

Edit your figures and get a professional valuation report.

Tri-it Limited Overview

Tri-it Limited is a live company located in birmingham, B11 2AA with a Companies House number of 06561671. It operates in the other information technology service activities sector, SIC Code 62090. Founded in April 2008, it's largest shareholder is vikash mohan with a 100% stake. Tri-it Limited is a established, micro sized company, Pomanda has estimated its turnover at £233.5k with low growth in recent years.

Upgrade for unlimited company reports & a free credit check

Tri-it Limited Health Check

Pomanda's financial health check has awarded Tri-It Limited a 2 rating. We use a traffic light system to show it exceeds the industry average on 2 measures and has 6 areas for improvement. Company Health Check FAQs

2 Strong

2 Regular

6 Weak

Size

annual sales of £233.5k, make it smaller than the average company (£6.9m)

- Tri-it Limited

£6.9m - Industry AVG

Growth

3 year (CAGR) sales growth of 2%, show it is growing at a slower rate (6.8%)

- Tri-it Limited

6.8% - Industry AVG

Production

with a gross margin of 50.3%, this company has a comparable cost of product (50.3%)

- Tri-it Limited

50.3% - Industry AVG

Profitability

an operating margin of -1.2% make it less profitable than the average company (3.5%)

- Tri-it Limited

3.5% - Industry AVG

Employees

with 2 employees, this is below the industry average (42)

2 - Tri-it Limited

42 - Industry AVG

Pay Structure

on an average salary of £71.6k, the company has an equivalent pay structure (£71.6k)

- Tri-it Limited

£71.6k - Industry AVG

Efficiency

resulting in sales per employee of £116.8k, this is less efficient (£173.1k)

- Tri-it Limited

£173.1k - Industry AVG

Debtor Days

it gets paid by customers after 36 days, this is earlier than average (53 days)

- Tri-it Limited

53 days - Industry AVG

Creditor Days

There is insufficient data available for this Key Performance Indicator!

- Tri-it Limited

- - Industry AVG

Stock Days

There is insufficient data available for this Key Performance Indicator!

- Tri-it Limited

- - Industry AVG

Cash Balance

has cash to cover current liabilities for 65 weeks, this is more cash available to meet short term requirements (15 weeks)

65 weeks - Tri-it Limited

15 weeks - Industry AVG

Debt Level

it has a ratio of liabilities to total assets of 74.5%, this is a higher level of debt than the average (63.4%)

74.5% - Tri-it Limited

63.4% - Industry AVG

TRI-IT LIMITED financials

Tri-It Limited's latest turnover from September 2023 is estimated at £233.5 thousand and the company has net assets of £15.5 thousand. According to their latest financial statements, Tri-It Limited has 2 employees and maintains cash reserves of £36.6 thousand as reported in the balance sheet.

Data source: Companies House, Pomanda Estimates

| Sep 2023 | Sep 2022 | Sep 2021 | Sep 2020 | Sep 2019 | Sep 2018 | Sep 2017 | Sep 2016 | Sep 2015 | Sep 2014 | Sep 2013 | Sep 2012 | Sep 2011 | Sep 2010 | Sep 2009 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Turnover | |||||||||||||||

| Other Income Or Grants | |||||||||||||||

| Cost Of Sales | |||||||||||||||

| Gross Profit | |||||||||||||||

| Admin Expenses | |||||||||||||||

| Operating Profit | |||||||||||||||

| Interest Payable | |||||||||||||||

| Interest Receivable | |||||||||||||||

| Pre-Tax Profit | |||||||||||||||

| Tax | |||||||||||||||

| Profit After Tax | |||||||||||||||

| Dividends Paid | |||||||||||||||

| Retained Profit | |||||||||||||||

| Employee Costs | |||||||||||||||

| Number Of Employees | 2 | 2 | 2 | 3 | 3 | 3 | 4 | 4 | |||||||

| EBITDA* |

* Earnings Before Interest, Tax, Depreciation and Amortisation

| Sep 2023 | Sep 2022 | Sep 2021 | Sep 2020 | Sep 2019 | Sep 2018 | Sep 2017 | Sep 2016 | Sep 2015 | Sep 2014 | Sep 2013 | Sep 2012 | Sep 2011 | Sep 2010 | Sep 2009 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tangible Assets | 365 | 722 | 70 | 350 | 477 | 111 | 64 | 128 | 431 | 913 | 1,733 | 3,450 | |||

| Intangible Assets | |||||||||||||||

| Investments & Other | |||||||||||||||

| Debtors (Due After 1 year) | |||||||||||||||

| Total Fixed Assets | 365 | 722 | 70 | 350 | 477 | 111 | 64 | 128 | 431 | 913 | 1,733 | 3,450 | |||

| Stock & work in progress | |||||||||||||||

| Trade Debtors | 23,145 | 28,669 | 25,567 | 19,107 | 11,674 | 17,122 | 6,226 | 11,684 | 23,204 | 9,805 | 10,096 | 42,768 | 14,182 | 4,989 | 2,482 |

| Group Debtors | |||||||||||||||

| Misc Debtors | 476 | 476 | 920 | 920 | 1,209 | 2,153 | 664 | 642 | 50 | ||||||

| Cash | 36,609 | 42,136 | 34,835 | 28,555 | 3,607 | 3,899 | 16,279 | 15,805 | 15,178 | 4,888 | 3,653 | ||||

| misc current assets | |||||||||||||||

| total current assets | 60,230 | 71,281 | 61,322 | 48,582 | 12,883 | 22,882 | 6,890 | 12,326 | 23,204 | 13,704 | 26,375 | 58,573 | 29,360 | 9,877 | 6,185 |

| total assets | 60,595 | 72,003 | 61,322 | 48,582 | 12,953 | 23,232 | 7,367 | 12,437 | 23,268 | 13,832 | 26,375 | 59,004 | 30,273 | 11,610 | 9,635 |

| Bank overdraft | 2,778 | 2,778 | 2,778 | 1,250 | 4,716 | 4,281 | 953 | ||||||||

| Bank loan | |||||||||||||||

| Trade Creditors | 4,705 | 1,393 | 836 | 2,376 | 440 | 1,976 | 48,793 | 50,755 | 41,186 | 55,201 | 26,375 | 14,201 | 3,648 | ||

| Group/Directors Accounts | 7,793 | ||||||||||||||

| other short term finances | |||||||||||||||

| hp & lease commitments | |||||||||||||||

| other current liabilities | 26,295 | 31,888 | 24,267 | 19,643 | 14,297 | 19,541 | 30,762 | 35,471 | |||||||

| total current liabilities | 29,073 | 34,666 | 31,750 | 22,286 | 19,849 | 21,917 | 35,483 | 38,400 | 48,793 | 50,755 | 41,186 | 55,201 | 26,375 | 14,201 | 11,441 |

| loans | 15,972 | 18,750 | 21,528 | 23,750 | |||||||||||

| hp & lease commitments | |||||||||||||||

| Accruals and Deferred Income | |||||||||||||||

| other liabilities | 13,026 | ||||||||||||||

| provisions | 69 | 137 | 13 | 67 | 91 | 22 | 13 | 26 | 87 | 183 | 364 | ||||

| total long term liabilities | 16,041 | 18,887 | 21,528 | 23,750 | 13 | 67 | 91 | 22 | 13 | 26 | 13,026 | 87 | 183 | 364 | |

| total liabilities | 45,114 | 53,553 | 53,278 | 46,036 | 19,862 | 21,984 | 35,574 | 38,422 | 48,806 | 50,781 | 54,212 | 55,288 | 26,558 | 14,565 | 11,441 |

| net assets | 15,481 | 18,450 | 8,044 | 2,546 | -6,909 | 1,248 | -28,207 | -25,985 | -25,538 | -36,949 | -27,837 | 3,716 | 3,715 | -2,955 | -1,806 |

| total shareholders funds | 15,481 | 18,450 | 8,044 | 2,546 | -6,909 | 1,248 | -28,207 | -25,985 | -25,538 | -36,949 | -27,837 | 3,716 | 3,715 | -2,955 | -1,806 |

| Sep 2023 | Sep 2022 | Sep 2021 | Sep 2020 | Sep 2019 | Sep 2018 | Sep 2017 | Sep 2016 | Sep 2015 | Sep 2014 | Sep 2013 | Sep 2012 | Sep 2011 | Sep 2010 | Sep 2009 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Operating Activities | |||||||||||||||

| Operating Profit | |||||||||||||||

| Depreciation | 357 | 361 | 70 | 280 | 337 | 268 | 120 | 64 | 64 | 431 | 422 | 2,160 | 1,717 | 1,700 | |

| Amortisation | |||||||||||||||

| Tax | |||||||||||||||

| Stock | |||||||||||||||

| Debtors | -5,524 | 2,658 | 6,460 | 7,144 | -6,392 | 12,385 | -5,436 | -10,878 | 13,399 | -291 | -32,672 | 28,586 | 9,193 | 2,457 | 2,532 |

| Creditors | -4,705 | 3,312 | 557 | -1,540 | 1,936 | -1,536 | -46,817 | -1,962 | 9,569 | -14,015 | 28,826 | 12,174 | 10,553 | 3,648 | |

| Accruals and Deferred Income | -5,593 | 7,621 | 4,624 | 5,346 | -5,244 | -11,221 | -4,709 | 35,471 | |||||||

| Deferred Taxes & Provisions | -68 | 137 | -13 | -54 | -24 | 69 | 9 | -13 | 26 | -87 | -96 | -181 | 364 | ||

| Cash flow from operations | |||||||||||||||

| Investing Activities | |||||||||||||||

| capital expenditure | |||||||||||||||

| Change in Investments | |||||||||||||||

| cash flow from investments | |||||||||||||||

| Financing Activities | |||||||||||||||

| Bank loans | |||||||||||||||

| Group/Directors Accounts | -7,793 | 7,793 | |||||||||||||

| Other Short Term Loans | |||||||||||||||

| Long term loans | -2,778 | -2,778 | -2,222 | 23,750 | |||||||||||

| Hire Purchase and Lease Commitments | |||||||||||||||

| other long term liabilities | -13,026 | 13,026 | |||||||||||||

| share issue | |||||||||||||||

| interest | |||||||||||||||

| cash flow from financing | |||||||||||||||

| cash and cash equivalents | |||||||||||||||

| cash | -5,527 | 7,301 | 6,280 | 28,555 | -3,607 | 3,607 | -3,899 | -12,380 | 474 | 627 | 10,290 | 1,235 | 3,653 | ||

| overdraft | 1,528 | -3,466 | 4,716 | -4,281 | 3,328 | 953 | |||||||||

| change in cash | -5,527 | 7,301 | 4,752 | 32,021 | -8,323 | 7,888 | -3,328 | -953 | -3,899 | -12,380 | 474 | 627 | 10,290 | 1,235 | 3,653 |

tri-it limited Credit Report and Business Information

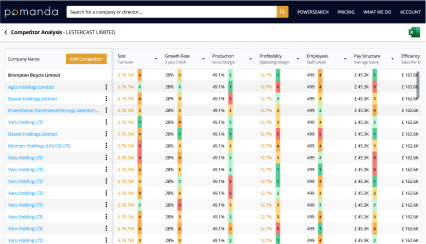

Tri-it Limited Competitor Analysis

Perform a competitor analysis for tri-it limited by selecting its closest rivals, whether from the INFORMATION AND COMMUNICATION sector, other micro companies, companies in B11 area or any other competitors across 12 key performance metrics.

tri-it limited Ownership

TRI-IT LIMITED group structure

Tri-It Limited has no subsidiary companies.

Ultimate parent company

TRI-IT LIMITED

06561671

tri-it limited directors

Tri-It Limited currently has 1 director, Mr Vikash Mohan serving since Apr 2008.

| officer | country | age | start | end | role |

|---|---|---|---|---|---|

| Mr Vikash Mohan | England | 49 years | Apr 2008 | - | Director |

P&L

September 2023turnover

233.5k

-4%

operating profit

-2.8k

0%

gross margin

50.3%

-3.02%

turnover

Turnover, or revenue, is the amount of sales generated by a company within the financial year.

Balance Sheet

September 2023net assets

15.5k

-0.16%

total assets

60.6k

-0.16%

cash

36.6k

-0.13%

net assets

Total assets minus all liabilities

tri-it limited company details

company number

06561671

Type

Private limited with Share Capital

industry

62090 - Other information technology and computer service activities

incorporation date

April 2008

age

17

incorporated

UK

ultimate parent company

accounts

Total Exemption Full

last accounts submitted

September 2023

previous names

N/A

accountant

-

auditor

-

address

fairgate house 205 kings road, tyseley, birmingham, west midlands, B11 2AA

Bank

-

Legal Advisor

-

tri-it limited Charges & Mortgages

A charge, or mortgage, refers to the rights a company gives to a lender in return for a loan, often in the form of security given over business assets.

We did not find charges/mortgages relating to tri-it limited.

tri-it limited Capital Raised & Share Issues BETA

When a company issues new shares, e.g. to new investors following a funding round, it is required to notify Companies House within one month of making an allotment of shares.

Click to start generating capital raising & share issue transactions for TRI-IT LIMITED. This can take several minutes, an email will notify you when this has completed.

tri-it limited Companies House Filings - See Documents

| date | description | view/download |

|---|