able 2 achieve limited Company Information

Company Number

07111584

Next Accounts

Dec 2025

Shareholders

o4a limited

Group Structure

View All

Industry

Other education n.e.c.

Registered Address

23-25 princes street, yeovil, somerset, BA20 1EN

Website

www.able2achieve.co.ukable 2 achieve limited Estimated Valuation

Pomanda estimates the enterprise value of ABLE 2 ACHIEVE LIMITED at £5.2m based on a Turnover of £6.4m and 0.81x industry multiple (adjusted for size and gross margin).

able 2 achieve limited Estimated Valuation

Pomanda estimates the enterprise value of ABLE 2 ACHIEVE LIMITED at £521.1k based on an EBITDA of £111.6k and a 4.67x industry multiple (adjusted for size and gross margin).

able 2 achieve limited Estimated Valuation

Pomanda estimates the enterprise value of ABLE 2 ACHIEVE LIMITED at £857.4k based on Net Assets of £359.5k and 2.38x industry multiple (adjusted for liquidity).

Edit your figures and get a professional valuation report.

Able 2 Achieve Limited Overview

Able 2 Achieve Limited is a live company located in somerset, BA20 1EN with a Companies House number of 07111584. It operates in the other education n.e.c. sector, SIC Code 85590. Founded in December 2009, it's largest shareholder is o4a limited with a 100% stake. Able 2 Achieve Limited is a established, mid sized company, Pomanda has estimated its turnover at £6.4m with high growth in recent years.

Able 2 Achieve Limited Health Check

Pomanda's financial health check has awarded Able 2 Achieve Limited a 3.5 rating. We use a traffic light system to show it exceeds the industry average on 5 measures and has 4 areas for improvement. Company Health Check FAQs

5 Strong

2 Regular

4 Weak

Size

annual sales of £6.4m, make it larger than the average company (£472.6k)

- Able 2 Achieve Limited

£472.6k - Industry AVG

Growth

3 year (CAGR) sales growth of 18%, show it is growing at a faster rate (7.4%)

- Able 2 Achieve Limited

7.4% - Industry AVG

Production

with a gross margin of 57.3%, this company has a comparable cost of product (57.3%)

- Able 2 Achieve Limited

57.3% - Industry AVG

Profitability

an operating margin of 1.6% make it less profitable than the average company (4.8%)

- Able 2 Achieve Limited

4.8% - Industry AVG

Employees

with 89 employees, this is above the industry average (12)

89 - Able 2 Achieve Limited

12 - Industry AVG

Pay Structure

on an average salary of £28.4k, the company has an equivalent pay structure (£28.4k)

- Able 2 Achieve Limited

£28.4k - Industry AVG

Efficiency

resulting in sales per employee of £72.2k, this is more efficient (£50.9k)

- Able 2 Achieve Limited

£50.9k - Industry AVG

Debtor Days

it gets paid by customers after 33 days, this is later than average (17 days)

- Able 2 Achieve Limited

17 days - Industry AVG

Creditor Days

its suppliers are paid after 27 days, this is slower than average (23 days)

- Able 2 Achieve Limited

23 days - Industry AVG

Stock Days

There is insufficient data available for this Key Performance Indicator!

- Able 2 Achieve Limited

- - Industry AVG

Cash Balance

has cash to cover current liabilities for 19 weeks, this is less cash available to meet short term requirements (125 weeks)

19 weeks - Able 2 Achieve Limited

125 weeks - Industry AVG

Debt Level

it has a ratio of liabilities to total assets of 52%, this is a higher level of debt than the average (21.3%)

52% - Able 2 Achieve Limited

21.3% - Industry AVG

ABLE 2 ACHIEVE LIMITED financials

Able 2 Achieve Limited's latest turnover from March 2024 is estimated at £6.4 million and the company has net assets of £359.5 thousand. According to their latest financial statements, Able 2 Achieve Limited has 89 employees and maintains cash reserves of £143.7 thousand as reported in the balance sheet.

Data source: Companies House, Pomanda Estimates

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | Mar 2014 | Mar 2013 | Mar 2012 | Mar 2011 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Turnover | ||||||||||||||

| Other Income Or Grants | ||||||||||||||

| Cost Of Sales | ||||||||||||||

| Gross Profit | ||||||||||||||

| Admin Expenses | ||||||||||||||

| Operating Profit | ||||||||||||||

| Interest Payable | ||||||||||||||

| Interest Receivable | ||||||||||||||

| Pre-Tax Profit | ||||||||||||||

| Tax | ||||||||||||||

| Profit After Tax | ||||||||||||||

| Dividends Paid | ||||||||||||||

| Retained Profit | ||||||||||||||

| Employee Costs | ||||||||||||||

| Number Of Employees | 89 | 74 | 75 | 77 | 117 | 117 | 115 | 113 | 111 | |||||

| EBITDA* |

* Earnings Before Interest, Tax, Depreciation and Amortisation

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | Mar 2014 | Mar 2013 | Mar 2012 | Mar 2011 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tangible Assets | 8,979 | 19,754 | 28,367 | 35,385 | 7,542 | 12,995 | 16,371 | 38,640 | 51,122 | 36,246 | 32,387 | 10,243 | 5,509 | |

| Intangible Assets | ||||||||||||||

| Investments & Other | ||||||||||||||

| Debtors (Due After 1 year) | ||||||||||||||

| Total Fixed Assets | 8,979 | 19,754 | 28,367 | 35,385 | 7,542 | 12,995 | 16,371 | 38,640 | 51,122 | 36,246 | 32,387 | 10,243 | 5,509 | |

| Stock & work in progress | ||||||||||||||

| Trade Debtors | 582,122 | 426,001 | 322,130 | 270,792 | 309,128 | 262,529 | 258,171 | 169,047 | 149,707 | 202,049 | 135,176 | 196,497 | 42,071 | 10,384 |

| Group Debtors | ||||||||||||||

| Misc Debtors | 13,668 | 13,392 | 9,143 | 7,206 | 7,361 | 10,636 | 5,554 | 19,871 | 43,976 | |||||

| Cash | 143,681 | 89,041 | 76,536 | 191,428 | 6,991 | 4,628 | 38,504 | 17,759 | 48,308 | 22,920 | 31,672 | 1,176 | 23,408 | 3,964 |

| misc current assets | ||||||||||||||

| total current assets | 739,471 | 528,434 | 407,809 | 469,426 | 323,480 | 277,793 | 302,229 | 206,677 | 241,991 | 224,969 | 166,848 | 197,673 | 65,479 | 14,348 |

| total assets | 748,450 | 548,188 | 436,176 | 504,811 | 331,022 | 290,788 | 318,600 | 245,317 | 293,113 | 261,215 | 199,235 | 207,916 | 70,988 | 14,348 |

| Bank overdraft | 78,000 | 78,000 | ||||||||||||

| Bank loan | ||||||||||||||

| Trade Creditors | 207,927 | 110,475 | 104,860 | 161,835 | 193,054 | 163,812 | 89,426 | 30,336 | 16,840 | 91,972 | 104,940 | 535,430 | 362,092 | 107,005 |

| Group/Directors Accounts | ||||||||||||||

| other short term finances | 2,507 | 10,000 | 88,000 | 78,000 | 78,000 | |||||||||

| hp & lease commitments | ||||||||||||||

| other current liabilities | 181,045 | 158,417 | 124,344 | 169,861 | 98,106 | 65,075 | 68,030 | 29,231 | 31,864 | |||||

| total current liabilities | 388,972 | 268,892 | 231,711 | 341,696 | 379,160 | 306,887 | 235,456 | 137,567 | 126,704 | 91,972 | 104,940 | 535,430 | 362,092 | 107,005 |

| loans | 2,500 | 15,432 | 61,432 | 139,432 | 217,432 | 295,432 | ||||||||

| hp & lease commitments | ||||||||||||||

| Accruals and Deferred Income | ||||||||||||||

| other liabilities | 360,432 | 440,538 | ||||||||||||

| provisions | ||||||||||||||

| total long term liabilities | 2,500 | 15,432 | 61,432 | 139,432 | 217,432 | 295,432 | 360,432 | 440,538 | ||||||

| total liabilities | 388,972 | 268,892 | 231,711 | 344,196 | 394,592 | 368,319 | 374,888 | 354,999 | 422,136 | 452,404 | 545,478 | 535,430 | 362,092 | 107,005 |

| net assets | 359,478 | 279,296 | 204,465 | 160,615 | -63,570 | -77,531 | -56,288 | -109,682 | -129,023 | -191,189 | -346,243 | -327,514 | -291,104 | -92,657 |

| total shareholders funds | 359,478 | 279,296 | 204,465 | 160,615 | -63,570 | -77,531 | -56,288 | -109,682 | -129,023 | -191,189 | -346,243 | -327,514 | -291,104 | -92,657 |

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | Mar 2019 | Mar 2018 | Mar 2017 | Mar 2016 | Mar 2015 | Mar 2014 | Mar 2013 | Mar 2012 | Mar 2011 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Operating Activities | ||||||||||||||

| Operating Profit | ||||||||||||||

| Depreciation | 10,775 | 16,040 | 16,518 | 14,642 | 4,803 | 10,137 | 25,568 | 24,743 | 16,177 | 15,205 | 11,189 | 4,026 | 1,836 | |

| Amortisation | ||||||||||||||

| Tax | ||||||||||||||

| Stock | ||||||||||||||

| Debtors | 156,397 | 108,120 | 53,275 | -38,491 | 43,324 | 9,440 | 74,807 | -4,765 | -8,366 | 66,873 | -61,321 | 154,426 | 31,687 | 10,384 |

| Creditors | 97,452 | 5,615 | -56,975 | -31,219 | 29,242 | 74,386 | 59,090 | 13,496 | -75,132 | -12,968 | -430,490 | 173,338 | 255,087 | 107,005 |

| Accruals and Deferred Income | 22,628 | 34,073 | -45,517 | 71,755 | 33,031 | -2,955 | 38,799 | -2,633 | 31,864 | |||||

| Deferred Taxes & Provisions | ||||||||||||||

| Cash flow from operations | ||||||||||||||

| Investing Activities | ||||||||||||||

| capital expenditure | ||||||||||||||

| Change in Investments | ||||||||||||||

| cash flow from investments | ||||||||||||||

| Financing Activities | ||||||||||||||

| Bank loans | ||||||||||||||

| Group/Directors Accounts | ||||||||||||||

| Other Short Term Loans | -2,507 | -7,493 | -78,000 | 10,000 | 78,000 | |||||||||

| Long term loans | -2,500 | -12,932 | -46,000 | -78,000 | -78,000 | -78,000 | 295,432 | |||||||

| Hire Purchase and Lease Commitments | ||||||||||||||

| other long term liabilities | -360,432 | -80,106 | 440,538 | |||||||||||

| share issue | ||||||||||||||

| interest | ||||||||||||||

| cash flow from financing | ||||||||||||||

| cash and cash equivalents | ||||||||||||||

| cash | 54,640 | 12,505 | -114,892 | 184,437 | 2,363 | -33,876 | 20,745 | -30,549 | 25,388 | -8,752 | 30,496 | -22,232 | 19,444 | 3,964 |

| overdraft | -78,000 | 78,000 | ||||||||||||

| change in cash | 54,640 | 12,505 | -114,892 | 184,437 | 2,363 | -33,876 | 98,745 | -30,549 | -52,612 | -8,752 | 30,496 | -22,232 | 19,444 | 3,964 |

able 2 achieve limited Credit Report and Business Information

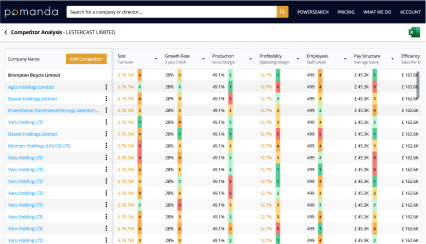

Able 2 Achieve Limited Competitor Analysis

Perform a competitor analysis for able 2 achieve limited by selecting its closest rivals, whether from the EDUCATION sector, other mid companies, companies in BA20 area or any other competitors across 12 key performance metrics.

able 2 achieve limited Ownership

ABLE 2 ACHIEVE LIMITED group structure

Able 2 Achieve Limited has no subsidiary companies.

Ultimate parent company

ABLE 2 ACHIEVE LIMITED

07111584

able 2 achieve limited directors

Able 2 Achieve Limited currently has 3 directors. The longest serving directors include Mrs Marika Elliott (Jun 2014) and Mr Shane Elliott (Mar 2023).

| officer | country | age | start | end | role |

|---|---|---|---|---|---|

| Mrs Marika Elliott | England | 57 years | Jun 2014 | - | Director |

| Mr Shane Elliott | England | 61 years | Mar 2023 | - | Director |

| Dr Stephane Mery | England | 60 years | Mar 2023 | - | Director |

P&L

March 2024turnover

6.4m

+38%

operating profit

100.8k

0%

gross margin

57.3%

-0.32%

turnover

Turnover, or revenue, is the amount of sales generated by a company within the financial year.

Balance Sheet

March 2024net assets

359.5k

+0.29%

total assets

748.5k

+0.37%

cash

143.7k

+0.61%

net assets

Total assets minus all liabilities

able 2 achieve limited company details

company number

07111584

Type

Private limited with Share Capital

industry

85590 - Other education n.e.c.

incorporation date

December 2009

age

16

incorporated

UK

ultimate parent company

accounts

Total Exemption Full

last accounts submitted

March 2024

previous names

N/A

accountant

GILBIE ROBERTS LIMITED

auditor

-

address

23-25 princes street, yeovil, somerset, BA20 1EN

Bank

-

Legal Advisor

-

able 2 achieve limited Charges & Mortgages

A charge, or mortgage, refers to the rights a company gives to a lender in return for a loan, often in the form of security given over business assets.

We found 2 charges/mortgages relating to able 2 achieve limited. Currently there are 0 open charges and 2 have been satisfied in the past.

able 2 achieve limited Capital Raised & Share Issues BETA

When a company issues new shares, e.g. to new investors following a funding round, it is required to notify Companies House within one month of making an allotment of shares.

Click to start generating capital raising & share issue transactions for ABLE 2 ACHIEVE LIMITED. This can take several minutes, an email will notify you when this has completed.

able 2 achieve limited Companies House Filings - See Documents

| date | description | view/download |

|---|