lrip e&c h5 gp limited Company Information

Company Number

11092435

Next Accounts

Mar 2026

Shareholders

lendlease europe holdings limited

cpp us re-1 inc

Group Structure

View All

Industry

Development of building projects

Registered Address

c/o pinsent masons llp, 30 crown place, london, EC2A 4ES

Website

http://lendlease.comlrip e&c h5 gp limited Estimated Valuation

Pomanda estimates the enterprise value of LRIP E&C H5 GP LIMITED at £1.2k based on a Turnover of £1k and 1.17x industry multiple (adjusted for size and gross margin).

lrip e&c h5 gp limited Estimated Valuation

Pomanda estimates the enterprise value of LRIP E&C H5 GP LIMITED at £8.9k based on an EBITDA of £1k and a 8.9x industry multiple (adjusted for size and gross margin).

lrip e&c h5 gp limited Estimated Valuation

Pomanda estimates the enterprise value of LRIP E&C H5 GP LIMITED at £7.2k based on Net Assets of £5.2k and 1.39x industry multiple (adjusted for liquidity).

Edit your figures and get a professional valuation report.

Lrip E&c H5 Gp Limited Overview

Lrip E&c H5 Gp Limited is a live company located in london, EC2A 4ES with a Companies House number of 11092435. It operates in the development of building projects sector, SIC Code 41100. Founded in December 2017, it's largest shareholder is lendlease europe holdings limited with a 70% stake. Lrip E&c H5 Gp Limited is a young, micro sized company, Pomanda has estimated its turnover at £1k with unknown growth in recent years.

Lrip E&c H5 Gp Limited Health Check

Pomanda's financial health check has awarded Lrip E&C H5 Gp Limited a 3 rating. We use a traffic light system to show it exceeds the industry average on 3 measures and has 3 areas for improvement. Company Health Check FAQs

3 Strong

0 Regular

3 Weak

Size

annual sales of £1k, make it smaller than the average company (£2.3m)

£1k - Lrip E&c H5 Gp Limited

£2.3m - Industry AVG

Growth

There is insufficient data available for this Key Performance Indicator!

- Lrip E&c H5 Gp Limited

- - Industry AVG

Production

with a gross margin of 100%, this company has a lower cost of product (26%)

100% - Lrip E&c H5 Gp Limited

26% - Industry AVG

Profitability

an operating margin of 100% make it more profitable than the average company (7.2%)

100% - Lrip E&c H5 Gp Limited

7.2% - Industry AVG

Employees

with 1 employees, this is below the industry average (7)

- Lrip E&c H5 Gp Limited

7 - Industry AVG

Pay Structure

There is insufficient data available for this Key Performance Indicator!

- Lrip E&c H5 Gp Limited

- - Industry AVG

Efficiency

resulting in sales per employee of £1k, this is less efficient (£277.7k)

- Lrip E&c H5 Gp Limited

£277.7k - Industry AVG

Debtor Days

There is insufficient data available for this Key Performance Indicator!

- - Lrip E&c H5 Gp Limited

- - Industry AVG

Creditor Days

There is insufficient data available for this Key Performance Indicator!

- - Lrip E&c H5 Gp Limited

- - Industry AVG

Stock Days

There is insufficient data available for this Key Performance Indicator!

- - Lrip E&c H5 Gp Limited

- - Industry AVG

Cash Balance

There is insufficient data available for this Key Performance Indicator!

- - Lrip E&c H5 Gp Limited

- - Industry AVG

Debt Level

it has a ratio of liabilities to total assets of 20%, this is a lower level of debt than the average (74%)

20% - Lrip E&c H5 Gp Limited

74% - Industry AVG

LRIP E&C H5 GP LIMITED financials

Lrip E&C H5 Gp Limited's latest turnover from June 2024 is £1 thousand and the company has net assets of £5.2 thousand. According to their latest financial statements, we estimate that Lrip E&C H5 Gp Limited has 1 employee and maintains cash reserves of 0 as reported in the balance sheet.

Data source: Companies House, Pomanda Estimates

| Jun 2024 | Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | Jun 2019 | Jun 2018 | |

|---|---|---|---|---|---|---|---|

| Turnover | 1,000 | 1,000 | 1,000 | 1,000 | 1,000 | 1,026 | 500 |

| Other Income Or Grants | |||||||

| Cost Of Sales | |||||||

| Gross Profit | 1,000 | 1,000 | 1,000 | 1,000 | 500 | ||

| Admin Expenses | |||||||

| Operating Profit | 1,000 | 1,000 | 1,000 | 1,000 | 970 | 1,011 | 500 |

| Interest Payable | |||||||

| Interest Receivable | |||||||

| Pre-Tax Profit | 1,000 | 1,000 | 1,000 | 1,000 | 970 | 1,011 | 500 |

| Tax | -250 | -27 | -428 | -190 | -204 | -168 | -99 |

| Profit After Tax | 750 | 973 | 572 | 810 | 766 | 843 | 401 |

| Dividends Paid | |||||||

| Retained Profit | 750 | 973 | 572 | 810 | 766 | 843 | 401 |

| Employee Costs | |||||||

| Number Of Employees | |||||||

| EBITDA* | 1,000 | 1,000 | 1,000 | 1,000 | 970 | 1,011 | 500 |

* Earnings Before Interest, Tax, Depreciation and Amortisation

| Jun 2024 | Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | Jun 2019 | Jun 2018 | |

|---|---|---|---|---|---|---|---|

| Tangible Assets | 200 | 200 | 200 | 200 | |||

| Intangible Assets | |||||||

| Investments & Other | 200 | 200 | 200 | 200 | 200 | 200 | |

| Debtors (Due After 1 year) | |||||||

| Total Fixed Assets | 200 | 200 | 200 | 200 | 200 | 200 | |

| Stock & work in progress | |||||||

| Trade Debtors | |||||||

| Group Debtors | 6,318 | 5,318 | 4,318 | 3,318 | 2,526 | 5,778 | 600 |

| Misc Debtors | 30 | ||||||

| Cash | 2 | ||||||

| misc current assets | 200 | ||||||

| total current assets | 6,318 | 5,318 | 4,318 | 3,318 | 2,526 | 5,810 | 800 |

| total assets | 6,518 | 5,518 | 4,518 | 3,518 | 2,726 | 6,010 | 800 |

| Bank overdraft | |||||||

| Bank loan | |||||||

| Trade Creditors | 4,182 | ||||||

| Group/Directors Accounts | 34 | 34 | |||||

| other short term finances | |||||||

| hp & lease commitments | |||||||

| other current liabilities | 1,269 | 1,019 | 34 | 34 | 242 | 314 | 299 |

| total current liabilities | 1,303 | 1,053 | 34 | 34 | 242 | 4,496 | 299 |

| loans | |||||||

| hp & lease commitments | |||||||

| Accruals and Deferred Income | |||||||

| other liabilities | |||||||

| provisions | 1,984 | 1,128 | 748 | 340 | |||

| total long term liabilities | 992 | 564 | 374 | 170 | |||

| total liabilities | 1,303 | 1,053 | 1,026 | 598 | 616 | 4,666 | 299 |

| net assets | 5,215 | 4,465 | 3,492 | 2,920 | 2,110 | 1,344 | 501 |

| total shareholders funds | 5,215 | 4,465 | 3,492 | 2,920 | 2,110 | 1,344 | 501 |

| Jun 2024 | Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | Jun 2019 | Jun 2018 | |

|---|---|---|---|---|---|---|---|

| Operating Activities | |||||||

| Operating Profit | 1,000 | 1,000 | 1,000 | 1,000 | 970 | 1,011 | 500 |

| Depreciation | |||||||

| Amortisation | |||||||

| Tax | -250 | -27 | -428 | -190 | -204 | -168 | -99 |

| Stock | |||||||

| Debtors | 1,000 | 1,000 | 1,000 | 792 | -3,282 | 5,208 | 600 |

| Creditors | -4,182 | 4,182 | |||||

| Accruals and Deferred Income | 250 | 985 | -208 | -72 | 15 | 299 | |

| Deferred Taxes & Provisions | -1,984 | 856 | 380 | 408 | 340 | ||

| Cash flow from operations | -1,026 | 428 | 190 | 202 | 172 | 100 | |

| Investing Activities | |||||||

| capital expenditure | |||||||

| Change in Investments | 200 | ||||||

| cash flow from investments | |||||||

| Financing Activities | |||||||

| Bank loans | |||||||

| Group/Directors Accounts | 34 | ||||||

| Other Short Term Loans | |||||||

| Long term loans | |||||||

| Hire Purchase and Lease Commitments | |||||||

| other long term liabilities | |||||||

| share issue | |||||||

| interest | |||||||

| cash flow from financing | 34 | 100 | |||||

| cash and cash equivalents | |||||||

| cash | -2 | 2 | |||||

| overdraft | |||||||

| change in cash | -2 | 2 |

lrip e&c h5 gp limited Credit Report and Business Information

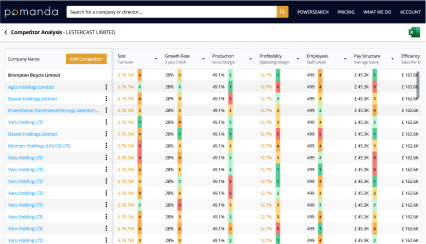

Lrip E&c H5 Gp Limited Competitor Analysis

Perform a competitor analysis for lrip e&c h5 gp limited by selecting its closest rivals, whether from the CONSTRUCTION sector, other micro companies, companies in EC2A area or any other competitors across 12 key performance metrics.

lrip e&c h5 gp limited Ownership

LRIP E&C H5 GP LIMITED group structure

Lrip E&C H5 Gp Limited has 2 subsidiary companies.

Ultimate parent company

LENDLEASE CORP LTD

#0016622

2 parents

LRIP E&C H5 GP LIMITED

11092435

2 subsidiaries

lrip e&c h5 gp limited directors

Lrip E&C H5 Gp Limited currently has 7 directors. The longest serving directors include Mr Geoffrey Willetts (Dec 2017) and Mr Thomas Jackson (Oct 2019).

| officer | country | age | start | end | role |

|---|---|---|---|---|---|

| Mr Geoffrey Willetts | England | 44 years | Dec 2017 | - | Director |

| Mr Thomas Jackson | United Kingdom | 43 years | Oct 2019 | - | Director |

| Ms Cheryl Maher | England | 37 years | Jul 2021 | - | Director |

| Mr Thomas Jackson | United Kingdom | 43 years | Jul 2021 | - | Director |

| Mr Sajjad Asharia | United Kingdom | 43 years | Feb 2022 | - | Director |

| Richa Srivastava | United Kingdom | 35 years | May 2023 | - | Director |

| Mr Matthew Hele | United Kingdom | 52 years | May 2023 | - | Director |

P&L

June 2024turnover

1k

0%

operating profit

1k

0%

gross margin

100%

0%

turnover

Turnover, or revenue, is the amount of sales generated by a company within the financial year.

Balance Sheet

June 2024net assets

5.2k

+0.17%

total assets

6.5k

+0.18%

cash

0

0%

net assets

Total assets minus all liabilities

lrip e&c h5 gp limited company details

company number

11092435

Type

Private limited with Share Capital

industry

41100 - Development of building projects

incorporation date

December 2017

age

8

incorporated

UK

ultimate parent company

accounts

Full Accounts

last accounts submitted

June 2024

previous names

N/A

accountant

-

auditor

KPMG CHANNEL ISLANDS LIMITED

address

c/o pinsent masons llp, 30 crown place, london, EC2A 4ES

Bank

-

Legal Advisor

-

lrip e&c h5 gp limited Charges & Mortgages

A charge, or mortgage, refers to the rights a company gives to a lender in return for a loan, often in the form of security given over business assets.

We did not find charges/mortgages relating to lrip e&c h5 gp limited.

lrip e&c h5 gp limited Capital Raised & Share Issues BETA

When a company issues new shares, e.g. to new investors following a funding round, it is required to notify Companies House within one month of making an allotment of shares.

Click to start generating capital raising & share issue transactions for LRIP E&C H5 GP LIMITED. This can take several minutes, an email will notify you when this has completed.

lrip e&c h5 gp limited Companies House Filings - See Documents

| date | description | view/download |

|---|