ac&h 231 limited Company Information

Company Number

SC316413

Next Accounts

30 days late

Shareholders

ac & h 181 ltd

Group Structure

View All

Industry

Development of building projects

+1Registered Address

first floor, 29 bothwell road, hamilton, south lanarkshire, ML3 0AS

Website

kimberleydevelopments.comac&h 231 limited Estimated Valuation

Pomanda estimates the enterprise value of AC&H 231 LIMITED at £0 based on a Turnover of £0 and 0.39x industry multiple (adjusted for size and gross margin).

ac&h 231 limited Estimated Valuation

Pomanda estimates the enterprise value of AC&H 231 LIMITED at £0 based on an EBITDA of £-6k and a 3.44x industry multiple (adjusted for size and gross margin).

ac&h 231 limited Estimated Valuation

Pomanda estimates the enterprise value of AC&H 231 LIMITED at £0 based on Net Assets of £-304.1k and 1.46x industry multiple (adjusted for liquidity).

Edit your figures and get a professional valuation report.

Ac&h 231 Limited Overview

Ac&h 231 Limited is a live company located in hamilton, ML3 0AS with a Companies House number of SC316413. It operates in the development of building projects sector, SIC Code 41100. Founded in February 2007, it's largest shareholder is ac & h 181 ltd with a 100% stake. Ac&h 231 Limited is a established, unknown sized company, Pomanda has estimated its turnover at £0 with unknown growth in recent years.

Ac&h 231 Limited Health Check

There is insufficient data available to calculate a health check for Ac&H 231 Limited. Company Health Check FAQs

0 Strong

0 Regular

2 Weak

Size

There is insufficient data available for this Key Performance Indicator!

- - Ac&h 231 Limited

- - Industry AVG

Growth

There is insufficient data available for this Key Performance Indicator!

- Ac&h 231 Limited

- - Industry AVG

Production

There is insufficient data available for this Key Performance Indicator!

- Ac&h 231 Limited

- - Industry AVG

Profitability

There is insufficient data available for this Key Performance Indicator!

- Ac&h 231 Limited

- - Industry AVG

Employees

There is insufficient data available for this Key Performance Indicator!

- - Ac&h 231 Limited

- - Industry AVG

Pay Structure

There is insufficient data available for this Key Performance Indicator!

- Ac&h 231 Limited

- - Industry AVG

Efficiency

There is insufficient data available for this Key Performance Indicator!

- Ac&h 231 Limited

- - Industry AVG

Debtor Days

There is insufficient data available for this Key Performance Indicator!

- Ac&h 231 Limited

- - Industry AVG

Creditor Days

There is insufficient data available for this Key Performance Indicator!

- Ac&h 231 Limited

- - Industry AVG

Stock Days

There is insufficient data available for this Key Performance Indicator!

- Ac&h 231 Limited

- - Industry AVG

Cash Balance

has cash to cover current liabilities for 0 weeks, this is less cash available to meet short term requirements (17 weeks)

- - Ac&h 231 Limited

- - Industry AVG

Debt Level

it has a ratio of liabilities to total assets of 162.5%, this is a higher level of debt than the average (70.5%)

- - Ac&h 231 Limited

- - Industry AVG

AC&H 231 LIMITED financials

Ac&H 231 Limited's latest turnover from June 2023 is estimated at 0 and the company has net assets of -£304.1 thousand. According to their latest financial statements, we estimate that Ac&H 231 Limited has no employees and maintains cash reserves of £496 as reported in the balance sheet.

Data source: Companies House, Pomanda Estimates

| Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | Jun 2019 | Jun 2018 | Jun 2017 | Jun 2016 | Jun 2015 | Jun 2014 | Jun 2013 | Jun 2012 | Jun 2011 | Jun 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Turnover | 542 | 5,437 | 13,982 | |||||||||||

| Other Income Or Grants | ||||||||||||||

| Cost Of Sales | ||||||||||||||

| Gross Profit | ||||||||||||||

| Admin Expenses | ||||||||||||||

| Operating Profit | 4,405 | 62,344 | -33,200 | |||||||||||

| Interest Payable | 29,557 | 29,887 | 37,213 | |||||||||||

| Interest Receivable | ||||||||||||||

| Pre-Tax Profit | -25,152 | -857,561 | -70,413 | |||||||||||

| Tax | ||||||||||||||

| Profit After Tax | -25,152 | -857,561 | -70,413 | |||||||||||

| Dividends Paid | ||||||||||||||

| Retained Profit | -25,152 | -857,561 | -70,413 | |||||||||||

| Employee Costs | ||||||||||||||

| Number Of Employees | ||||||||||||||

| EBITDA* | 4,405 | 62,344 | -33,200 |

* Earnings Before Interest, Tax, Depreciation and Amortisation

| Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | Jun 2019 | Jun 2018 | Jun 2017 | Jun 2016 | Jun 2015 | Jun 2014 | Jun 2013 | Jun 2012 | Jun 2011 | Jun 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tangible Assets | ||||||||||||||

| Intangible Assets | ||||||||||||||

| Investments & Other | ||||||||||||||

| Debtors (Due After 1 year) | ||||||||||||||

| Total Fixed Assets | ||||||||||||||

| Stock & work in progress | 1,016,263 | 480,057 | 500,000 | 505,040 | 505,040 | 505,040 | 505,040 | 500,000 | 1,390,018 | |||||

| Trade Debtors | 18,000 | 317,423 | 1,108,274 | 1,348,387 | 2,660 | 5,002 | ||||||||

| Group Debtors | 486,019 | 511,378 | 978,383 | 895 | 410,823 | 706,697 | 854,117 | |||||||

| Misc Debtors | 361 | 3,111 | 32,715 | 126,884 | 1,554,269 | 33,313 | 32,715 | 17,039 | 14,236 | 600 | 50 | |||

| Cash | 496 | 2,315 | 324,056 | 31,787 | 84,647 | 97,809 | 8,326 | 1,917 | 2,797 | 1,543 | 109 | |||

| misc current assets | ||||||||||||||

| total current assets | 486,876 | 516,804 | 1,335,154 | 176,671 | 1,639,811 | 1,464,808 | 931,921 | 1,225,653 | 1,376,190 | 1,614,857 | 1,853,536 | 505,640 | 502,710 | 1,395,020 |

| total assets | 486,876 | 516,804 | 1,335,154 | 176,671 | 1,639,811 | 1,464,808 | 931,921 | 1,225,653 | 1,376,190 | 1,614,857 | 1,853,536 | 505,640 | 502,710 | 1,395,020 |

| Bank overdraft | 1,085,262 | 1,077,485 | 136,405 | |||||||||||

| Bank loan | 1,911,248 | 2,048,095 | 130,471 | |||||||||||

| Trade Creditors | 385,655 | 939,128 | 1,044,974 | |||||||||||

| Group/Directors Accounts | 783,317 | 784,337 | 784,742 | 1,331,737 | 2,112,336 | 2,110,996 | 754,283 | 754,283 | 753,831 | 445,452 | 395,659 | 396,105 | ||

| other short term finances | ||||||||||||||

| hp & lease commitments | ||||||||||||||

| other current liabilities | 7,650 | 30,625 | 532,227 | 107,399 | 1,527,451 | 1,350,941 | 104,385 | 179,239 | 59,234 | 99,944 | 129,432 | 194,815 | ||

| total current liabilities | 790,967 | 814,962 | 1,702,624 | 1,439,136 | 3,639,787 | 3,461,937 | 2,769,916 | 2,981,617 | 943,536 | 939,128 | 1,044,974 | 1,630,658 | 1,602,576 | 727,325 |

| loans | 1,901,736 | 910,000 | ||||||||||||

| hp & lease commitments | ||||||||||||||

| Accruals and Deferred Income | ||||||||||||||

| other liabilities | 2,036,425 | 2,065,315 | ||||||||||||

| provisions | ||||||||||||||

| total long term liabilities | 1,901,736 | 2,036,425 | 2,065,315 | 910,000 | ||||||||||

| total liabilities | 790,967 | 814,962 | 1,702,624 | 1,439,136 | 3,639,787 | 3,461,937 | 2,769,916 | 2,981,617 | 2,845,272 | 2,975,553 | 3,110,289 | 1,630,658 | 1,602,576 | 1,637,325 |

| net assets | -304,091 | -298,158 | -367,470 | -1,262,465 | -1,999,976 | -1,997,129 | -1,837,995 | -1,755,964 | -1,469,082 | -1,360,696 | -1,256,753 | -1,125,018 | -1,099,866 | -242,305 |

| total shareholders funds | -304,091 | -298,158 | -367,470 | -1,262,465 | -1,999,976 | -1,997,129 | -1,837,995 | -1,755,964 | -1,469,082 | -1,360,696 | -1,256,753 | -1,125,018 | -1,099,866 | -242,305 |

| Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | Jun 2019 | Jun 2018 | Jun 2017 | Jun 2016 | Jun 2015 | Jun 2014 | Jun 2013 | Jun 2012 | Jun 2011 | Jun 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Operating Activities | ||||||||||||||

| Operating Profit | 4,405 | 62,344 | -33,200 | |||||||||||

| Depreciation | ||||||||||||||

| Amortisation | ||||||||||||||

| Tax | ||||||||||||||

| Stock | -1,016,263 | 536,206 | -19,943 | -5,040 | 5,040 | -890,018 | 1,390,018 | |||||||

| Debtors | -28,109 | -496,609 | 866,214 | -1,410,280 | 1,204,428 | -92,802 | -280,198 | -144,617 | -239,921 | -240,113 | 1,347,787 | -2,110 | -2,292 | 5,002 |

| Creditors | -385,655 | 385,655 | -939,128 | -105,846 | 1,044,974 | |||||||||

| Accruals and Deferred Income | -22,975 | -501,602 | 424,828 | -1,420,052 | 176,510 | 1,246,556 | -74,854 | 120,005 | 59,234 | -99,944 | -29,488 | -65,383 | 194,815 | |

| Deferred Taxes & Provisions | ||||||||||||||

| Cash flow from operations | -28,013 | 889,271 | -1,233,405 | |||||||||||

| Investing Activities | ||||||||||||||

| capital expenditure | ||||||||||||||

| Change in Investments | ||||||||||||||

| cash flow from investments | ||||||||||||||

| Financing Activities | ||||||||||||||

| Bank loans | -1,911,248 | -136,847 | 1,917,624 | 130,471 | ||||||||||

| Group/Directors Accounts | -1,020 | -405 | -546,995 | -780,599 | 1,340 | 1,356,713 | 452 | 753,831 | -445,452 | 49,793 | -446 | 396,105 | ||

| Other Short Term Loans | ||||||||||||||

| Long term loans | -1,901,736 | 1,901,736 | -910,000 | 910,000 | ||||||||||

| Hire Purchase and Lease Commitments | ||||||||||||||

| other long term liabilities | -2,036,425 | -28,890 | 2,065,315 | |||||||||||

| share issue | ||||||||||||||

| interest | -29,557 | -29,887 | -37,213 | |||||||||||

| cash flow from financing | 20,236 | -940,333 | 1,097,000 | |||||||||||

| cash and cash equivalents | ||||||||||||||

| cash | -1,819 | -321,741 | 292,269 | -52,860 | -13,162 | 89,483 | 6,409 | -880 | 1,254 | 1,434 | 109 | |||

| overdraft | -1,085,262 | 7,777 | 941,080 | 136,405 | ||||||||||

| change in cash | -1,819 | -321,741 | 292,269 | -52,860 | -13,162 | 89,483 | 6,409 | -880 | 1,254 | 1,434 | 1,085,371 | -7,777 | -941,080 | -136,405 |

ac&h 231 limited Credit Report and Business Information

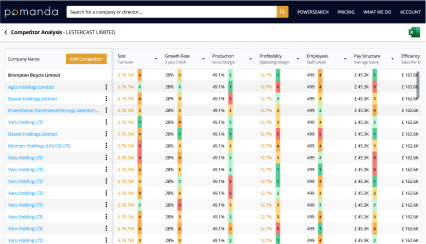

Ac&h 231 Limited Competitor Analysis

Perform a competitor analysis for ac&h 231 limited by selecting its closest rivals, whether from the CONSTRUCTION sector, other established companies, companies in ML3 area or any other competitors across 12 key performance metrics.

ac&h 231 limited Ownership

AC&H 231 LIMITED group structure

Ac&H 231 Limited has no subsidiary companies.

ac&h 231 limited directors

Ac&H 231 Limited currently has 3 directors. The longest serving directors include Mr Douglas Burt (Apr 2007) and Mr Hugh Caseley (Apr 2007).

| officer | country | age | start | end | role |

|---|---|---|---|---|---|

| Mr Douglas Burt | 67 years | Apr 2007 | - | Director | |

| Mr Hugh Caseley | England | 64 years | Apr 2007 | - | Director |

| Mr Philip Pearce | England | 66 years | Apr 2007 | - | Director |

P&L

June 2023turnover

0

0%

operating profit

-6k

0%

gross margin

0%

0%

turnover

Turnover, or revenue, is the amount of sales generated by a company within the financial year.

Balance Sheet

June 2023net assets

-304.1k

+0.02%

total assets

486.9k

-0.06%

cash

496

-0.79%

net assets

Total assets minus all liabilities

ac&h 231 limited company details

company number

SC316413

Type

Private limited with Share Capital

industry

41100 - Development of building projects

41201 - Construction of commercial buildings

incorporation date

February 2007

age

18

incorporated

UK

ultimate parent company

accounts

Small Company

last accounts submitted

June 2023

previous names

N/A

accountant

CROWE U.K LLP

auditor

-

address

first floor, 29 bothwell road, hamilton, south lanarkshire, ML3 0AS

Bank

-

Legal Advisor

-

ac&h 231 limited Charges & Mortgages

A charge, or mortgage, refers to the rights a company gives to a lender in return for a loan, often in the form of security given over business assets.

We found 6 charges/mortgages relating to ac&h 231 limited. Currently there are 0 open charges and 6 have been satisfied in the past.

ac&h 231 limited Capital Raised & Share Issues BETA

When a company issues new shares, e.g. to new investors following a funding round, it is required to notify Companies House within one month of making an allotment of shares.

Click to start generating capital raising & share issue transactions for AC&H 231 LIMITED. This can take several minutes, an email will notify you when this has completed.

ac&h 231 limited Companies House Filings - See Documents

| date | description | view/download |

|---|