middlefield court (hinckley) limited Company Information

Company Number

03317956

Next Accounts

Nov 2025

Industry

Management of real estate on a fee or contract basis

Directors

Shareholders

margaret ann faint

c. randle

View AllGroup Structure

View All

Contact

Registered Address

14 middlefield court, hinckley, leicestershire, LE10 0QT

Website

-middlefield court (hinckley) limited Estimated Valuation

Pomanda estimates the enterprise value of MIDDLEFIELD COURT (HINCKLEY) LIMITED at £58.7k based on a Turnover of £35.3k and 1.66x industry multiple (adjusted for size and gross margin).

middlefield court (hinckley) limited Estimated Valuation

Pomanda estimates the enterprise value of MIDDLEFIELD COURT (HINCKLEY) LIMITED at £8.5k based on an EBITDA of £1.7k and a 5.03x industry multiple (adjusted for size and gross margin).

middlefield court (hinckley) limited Estimated Valuation

Pomanda estimates the enterprise value of MIDDLEFIELD COURT (HINCKLEY) LIMITED at £36.1k based on Net Assets of £20.2k and 1.79x industry multiple (adjusted for liquidity).

Edit your figures and get a professional valuation report.

Middlefield Court (hinckley) Limited Overview

Middlefield Court (hinckley) Limited is a live company located in leicestershire, LE10 0QT with a Companies House number of 03317956. It operates in the management of real estate on a fee or contract basis sector, SIC Code 68320. Founded in February 1997, it's largest shareholder is margaret ann faint with a 4.5% stake. Middlefield Court (hinckley) Limited is a mature, micro sized company, Pomanda has estimated its turnover at £35.3k with high growth in recent years.

Upgrade for unlimited company reports & a free credit check

Middlefield Court (hinckley) Limited Health Check

Pomanda's financial health check has awarded Middlefield Court (Hinckley) Limited a 2 rating. We use a traffic light system to show it exceeds the industry average on 2 measures and has 7 areas for improvement. Company Health Check FAQs

2 Strong

1 Regular

7 Weak

Size

annual sales of £35.3k, make it smaller than the average company (£999.3k)

- Middlefield Court (hinckley) Limited

£999.3k - Industry AVG

Growth

3 year (CAGR) sales growth of 18%, show it is growing at a faster rate (6.5%)

- Middlefield Court (hinckley) Limited

6.5% - Industry AVG

Production

with a gross margin of 12.9%, this company has a higher cost of product (44.5%)

- Middlefield Court (hinckley) Limited

44.5% - Industry AVG

Profitability

an operating margin of 4.8% make it less profitable than the average company (9.3%)

- Middlefield Court (hinckley) Limited

9.3% - Industry AVG

Employees

with 1 employees, this is below the industry average (9)

- Middlefield Court (hinckley) Limited

9 - Industry AVG

Pay Structure

on an average salary of £40.4k, the company has an equivalent pay structure (£40.4k)

- Middlefield Court (hinckley) Limited

£40.4k - Industry AVG

Efficiency

resulting in sales per employee of £35.3k, this is less efficient (£111.5k)

- Middlefield Court (hinckley) Limited

£111.5k - Industry AVG

Debtor Days

it gets paid by customers after 133 days, this is later than average (29 days)

- Middlefield Court (hinckley) Limited

29 days - Industry AVG

Creditor Days

its suppliers are paid after 5 days, this is quicker than average (30 days)

- Middlefield Court (hinckley) Limited

30 days - Industry AVG

Stock Days

There is insufficient data available for this Key Performance Indicator!

- Middlefield Court (hinckley) Limited

- - Industry AVG

Cash Balance

There is insufficient data available for this Key Performance Indicator!

- - Middlefield Court (hinckley) Limited

- - Industry AVG

Debt Level

it has a ratio of liabilities to total assets of 2.2%, this is a lower level of debt than the average (78.4%)

2.2% - Middlefield Court (hinckley) Limited

78.4% - Industry AVG

MIDDLEFIELD COURT (HINCKLEY) LIMITED financials

Middlefield Court (Hinckley) Limited's latest turnover from February 2024 is estimated at £35.3 thousand and the company has net assets of £20.2 thousand. According to their latest financial statements, we estimate that Middlefield Court (Hinckley) Limited has 1 employee and maintains cash reserves of 0 as reported in the balance sheet.

Data source: Companies House, Pomanda Estimates

| Feb 2024 | Feb 2023 | Feb 2022 | Feb 2021 | Feb 2020 | Feb 2019 | Feb 2018 | Feb 2017 | Feb 2016 | Feb 2015 | Feb 2014 | Feb 2013 | Feb 2012 | Feb 2011 | Feb 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Turnover | |||||||||||||||

| Other Income Or Grants | |||||||||||||||

| Cost Of Sales | |||||||||||||||

| Gross Profit | |||||||||||||||

| Admin Expenses | |||||||||||||||

| Operating Profit | |||||||||||||||

| Interest Payable | |||||||||||||||

| Interest Receivable | |||||||||||||||

| Pre-Tax Profit | |||||||||||||||

| Tax | |||||||||||||||

| Profit After Tax | |||||||||||||||

| Dividends Paid | |||||||||||||||

| Retained Profit | |||||||||||||||

| Employee Costs | |||||||||||||||

| Number Of Employees | |||||||||||||||

| EBITDA* |

* Earnings Before Interest, Tax, Depreciation and Amortisation

| Feb 2024 | Feb 2023 | Feb 2022 | Feb 2021 | Feb 2020 | Feb 2019 | Feb 2018 | Feb 2017 | Feb 2016 | Feb 2015 | Feb 2014 | Feb 2013 | Feb 2012 | Feb 2011 | Feb 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Tangible Assets | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 |

| Intangible Assets | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Investments & Other | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Debtors (Due After 1 year) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Fixed Assets | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 | 7,709 |

| Stock & work in progress | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Trade Debtors | 12,923 | 11,845 | 11,385 | 9,815 | 8,882 | 7,581 | 6,874 | 7,438 | 0 | 0 | 0 | 0 | 0 | 4 | 300 |

| Group Debtors | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Misc Debtors | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Cash | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 6,084 | 4,673 | 4,128 | 2,165 | 2,584 | 1,877 | 243 |

| misc current assets | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| total current assets | 12,923 | 11,845 | 11,385 | 9,815 | 8,882 | 7,581 | 6,874 | 7,438 | 6,084 | 4,673 | 4,128 | 2,165 | 2,584 | 1,881 | 543 |

| total assets | 20,632 | 19,554 | 19,094 | 17,524 | 16,591 | 15,290 | 14,583 | 15,147 | 13,793 | 12,382 | 11,837 | 9,874 | 10,293 | 9,590 | 8,252 |

| Bank overdraft | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Bank loan | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Trade Creditors | 460 | 647 | 396 | 62 | 120 | 157 | 0 | 840 | 540 | 548 | 240 | 240 | 1,104 | 246 | 235 |

| Group/Directors Accounts | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| other short term finances | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| hp & lease commitments | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| other current liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| total current liabilities | 460 | 647 | 396 | 62 | 120 | 157 | 0 | 840 | 540 | 548 | 240 | 240 | 1,104 | 246 | 235 |

| loans | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| hp & lease commitments | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Accruals and Deferred Income | 0 | 0 | 0 | 360 | 300 | 300 | 300 | 300 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| other liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| provisions | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| total long term liabilities | 0 | 0 | 0 | 360 | 300 | 300 | 300 | 300 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| total liabilities | 460 | 647 | 396 | 422 | 420 | 457 | 300 | 1,140 | 540 | 548 | 240 | 240 | 1,104 | 246 | 235 |

| net assets | 20,172 | 18,907 | 18,698 | 17,102 | 16,171 | 14,833 | 14,283 | 14,007 | 13,253 | 11,834 | 11,597 | 9,634 | 9,189 | 9,344 | 8,017 |

| total shareholders funds | 20,172 | 18,907 | 18,698 | 17,102 | 16,171 | 14,833 | 14,283 | 14,007 | 13,253 | 11,834 | 11,597 | 9,634 | 9,189 | 9,344 | 8,017 |

| Feb 2024 | Feb 2023 | Feb 2022 | Feb 2021 | Feb 2020 | Feb 2019 | Feb 2018 | Feb 2017 | Feb 2016 | Feb 2015 | Feb 2014 | Feb 2013 | Feb 2012 | Feb 2011 | Feb 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Operating Activities | |||||||||||||||

| Operating Profit | |||||||||||||||

| Depreciation | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Amortisation | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Tax | |||||||||||||||

| Stock | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Debtors | 1,078 | 460 | 1,570 | 933 | 1,301 | 707 | -564 | 7,438 | 0 | 0 | 0 | 0 | -4 | -296 | 300 |

| Creditors | -187 | 251 | 334 | -58 | -37 | 157 | -840 | 300 | -8 | 308 | 0 | -864 | 858 | 11 | 235 |

| Accruals and Deferred Income | 0 | 0 | -360 | 60 | 0 | 0 | 0 | 300 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Deferred Taxes & Provisions | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Cash flow from operations | |||||||||||||||

| Investing Activities | |||||||||||||||

| capital expenditure | |||||||||||||||

| Change in Investments | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| cash flow from investments | |||||||||||||||

| Financing Activities | |||||||||||||||

| Bank loans | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Group/Directors Accounts | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Other Short Term Loans | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Long term loans | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hire Purchase and Lease Commitments | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| other long term liabilities | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| share issue | |||||||||||||||

| interest | |||||||||||||||

| cash flow from financing | |||||||||||||||

| cash and cash equivalents | |||||||||||||||

| cash | 0 | 0 | 0 | 0 | 0 | 0 | 0 | -6,084 | 1,411 | 545 | 1,963 | -419 | 707 | 1,634 | 243 |

| overdraft | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| change in cash | 0 | 0 | 0 | 0 | 0 | 0 | 0 | -6,084 | 1,411 | 545 | 1,963 | -419 | 707 | 1,634 | 243 |

middlefield court (hinckley) limited Credit Report and Business Information

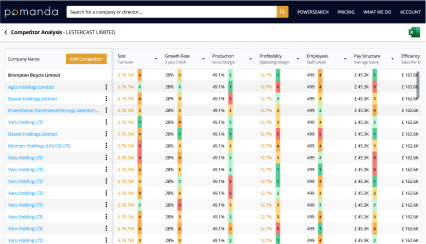

Middlefield Court (hinckley) Limited Competitor Analysis

Perform a competitor analysis for middlefield court (hinckley) limited by selecting its closest rivals, whether from the REAL ESTATE ACTIVITIES sector, other micro companies, companies in LE10 area or any other competitors across 12 key performance metrics.

middlefield court (hinckley) limited Ownership

MIDDLEFIELD COURT (HINCKLEY) LIMITED group structure

Middlefield Court (Hinckley) Limited has no subsidiary companies.

Ultimate parent company

MIDDLEFIELD COURT (HINCKLEY) LIMITED

03317956

middlefield court (hinckley) limited directors

Middlefield Court (Hinckley) Limited currently has 1 director, Mr Philip Worley serving since Jul 2023.

| officer | country | age | start | end | role |

|---|---|---|---|---|---|

| Mr Philip Worley | England | 73 years | Jul 2023 | - | Director |

P&L

February 2024turnover

35.3k

+31%

operating profit

1.7k

0%

gross margin

13%

-1.39%

turnover

Turnover, or revenue, is the amount of sales generated by a company within the financial year.

Balance Sheet

February 2024net assets

20.2k

+0.07%

total assets

20.6k

+0.06%

cash

0

0%

net assets

Total assets minus all liabilities

middlefield court (hinckley) limited company details

company number

03317956

Type

Private limited with Share Capital

industry

68320 - Management of real estate on a fee or contract basis

incorporation date

February 1997

age

27

incorporated

UK

ultimate parent company

accounts

Micro-Entity Accounts

last accounts submitted

February 2024

previous names

N/A

accountant

-

auditor

-

address

14 middlefield court, hinckley, leicestershire, LE10 0QT

Bank

-

Legal Advisor

-

middlefield court (hinckley) limited Charges & Mortgages

A charge, or mortgage, refers to the rights a company gives to a lender in return for a loan, often in the form of security given over business assets.

We did not find charges/mortgages relating to middlefield court (hinckley) limited.

middlefield court (hinckley) limited Capital Raised & Share Issues BETA

When a company issues new shares, e.g. to new investors following a funding round, it is required to notify Companies House within one month of making an allotment of shares.

Click to start generating capital raising & share issue transactions for MIDDLEFIELD COURT (HINCKLEY) LIMITED. This can take several minutes, an email will notify you when this has completed.

middlefield court (hinckley) limited Companies House Filings - See Documents

| date | description | view/download |

|---|